Steady expansion of cloud computing to create new growth areas, expand offerings and micro-differentiate vendors

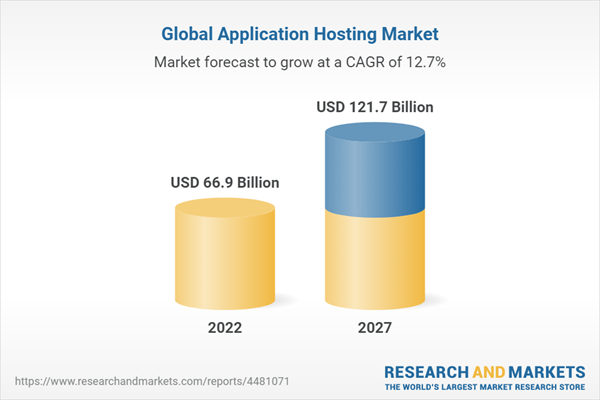

Global Application Hosting Market

Dublin, Nov. 10, 2022 (GLOBE NEWSWIRE) — The “Global Application Hosting Market by Hosting Type (Managed, Cloud and Colocation), Service Type, Application Type (Web-based, Mobile), Company Size, Industry and Region (North America, Europe, APAC, Latin America, MEA) – Forecast to 2027” was added to the report ResearchAndMarkets.com Offer.

The application hosting market is projected to grow from US$66.9 billion in 2022 to US$121.7 billion in 2027 at a CAGR of 12.7% over the forecast period.

By organization size, the SME segment is expected to register a higher CAGR during the forecast period

SMBs are a faster growing segment of the application hosting market compared to large enterprises. Most of these organizations lack the funds to build their infrastructure and devote resources to managing that infrastructure. Cloud hosting services allow these organizations to host their applications while using another service provider’s infrastructure at an affordable cost. Features such as flexibility, disaster recovery, automatic updates, CAPEX-free, collaboration, document control, and security encourage SMBs to host their applications in the cloud environment at a rapid pace.

It is estimated that the web-based application type will account for the largest market share in 2022

Web technologies are changing rapidly with the development of new technologies. These technologies are transforming enterprise business applications. Companies understand the importance of web-based applications and are therefore investing more in this segment to gain a competitive advantage. In addition, companies are integrating the latest technologies such as AI chatbots, Motion UI, blockchain, augmented reality (AR) and push notifications into their web-based applications.

Among the regions, the Asia-Pacific market is expected to register the highest CAGR during the forecast period

The growth of the application hosting market in Asia Pacific is strongly driven by technological advancements across the region. China is expected to be the leading market for application hosting solutions in this region. The existence of a large population and the development of infrastructure and technology are important factors contributing to the growth of the Asia Pacific application hosting market. BFIS is driving the demand for application hosting solutions in the region as technology adoption by various industries such as retail and e-commerce is increasing rapidly.

Main topics covered:

1 Introduction

2 research methodology

3 Summary

4 premium insights

4.1 Attractive Opportunities for Key Players in Application Hosting

4.2 North America Market, by Hosting Type and Industry Segment

4.3 Asia Pacific Market, 2022

4.4 Market, by Country

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Avoiding the risk of granting system access to third parties

5.2.1.2 Software-centric competitive advantage approach gains cross-industry acceptance

5.2.1.3 Application hosting enables a stronger focus on core business processes by providing business-specific IT solutions

5.2.1.4 Comprehensive hosting solutions with a range of complementary services to the core offerings

5.2.2 Restrictions

5.2.2.1 Security and privacy concerns prevent organizational change

5.2.2.2 Regional IT development presents infrastructural challenges for the implementation of hosting technology

5.2.2.3 Local regulations prohibit entry

5.2.3 Opportunities

5.2.3.1 Continued expansion of cloud computing to create new growth areas, broadening of offerings and micro-differentiation of providers

5.2.3.2 Managed Services on the rise over traditional approaches

5.2.3.3 Innovative service delivery with advantage over competitors

5.2.4 Challenges

5.2.4.1 Vendor lock-in for cloud hosting could hamper the flexibility organizations desire

5.2.4.2 Providing Scalability

5.2.5 Cumulative Growth Analysis

5.3 Application Hosting Market: Supply Chain Analysis

5.4 Ecosystem

5.5 Porter’s Five Forces Analysis

5.6 Technology Analysis

5.7 Trends and Disruptions Affecting Buyers

5.8 Patent Analysis

5.8.1 Methodology

5.8.2 Document Type

5.8.3 Innovation and Patent Application

5.8.3.1 Top Contenders

5.9 Price Analysis

5.10 Case Study Analysis

5.10.1 Case Study 1: Worldsys uses Oracle’s solution to improve agility

5.10.2 Case study 2: Improved refill process for specialty pharmacies with Liquid Web’s Hipaa compliant hosting

5.10.3 Case Study 3: Sungard Delivered Secure and Robust Solution with Ecs

5.10.4 Case study 4: Dxc technology delivers scalable and cost-effective environment to Goldensource

5.10.5 Case Study 5: Deploying Orion on Liquid Web cloud infrastructure for elastic scalability

5.11 Major Conferences and Events in 2022

5.12 Legal Compliance

6 Application Hosting Market by Hosting Type

6.1 Introduction

6.1.1 Hosting Type: Market Drivers

6.2 Managed Hosting

6.2.1 Companies with large legacy systems that should choose managed hosting

6.3 Cloud Hosting

6.3.1 Reduced infrastructure, low maintenance costs, 24/7 data access and effective drive segment monitoring

6.3.2 Infrastructure as a Service

6.3.3 Platform as a Service

6.3.4 Software as a Service

6.4 Colocation Hosting

6.4.1 Scalability and physical security for the disk segment

7 Application Hosting Market by Service Type

7.1 Introduction

7.1.1 Service Type: Market Driver

7.2 Application Monitoring

7.2.1 Complexity of installing enterprise software for the powertrain segment

7.3 Application Programming Interface Management

7.3.1 Manages API traffic internally and externally

7.4 Infrastructure Services

7.4.1 Bridge between actual resources and applications

7.5 Database Management

7.5.1 Simplifies database setup in cloud and on-premises

7.6 Backup and Restore

7.6.1 Improved uptime and reduced application downtime during hosting

7.7 Application Security

7.7.1 Increase in Security Breaches in Drive Segment

8 Application Hosting Market by Application Type

8.1 Introduction

8.1.1 Application Type: Market Drivers

8.2 Mobile Applications

8.2.1 Accelerated mobile pages to improve user experience and page loading speed

8.3 Web-based Applications

8.3.1 Development of new technologies to transform business applications in companies

9 Application Hosting Market by Enterprise Size

9.1 Introduction

9.1.1 Company Size: Market Drivers

9.2 Large Companies

9.2.1 The emergence of digital channels, e-commerce and social media are making companies invest heavily

9.3 SMEs

9.3.1 Cloud hosting services allow these organizations to host their applications

10 Application Hosting Market by Industry

10.1 Introduction

10.1.1 Industries: market drivers

10.2 Banking, Financial Services and Insurance

10.2.1 Cloud hosting helps identify and create significant opportunities that help banks develop customer-centric business models

10.3 Ites

10.3.1 Investing in new technology to drive the market

10.4 Telecom

10.4.1 High availability, reliability and ability to use the existing network infrastructure to drive the market

10.5 Media & Entertainment

10.5.1 Hosting of media and entertainment applications to enable businesses to grow customer base

10.6 Retail and E-Commerce

10.6.1 Application hosting services allow for the integration of multiple purchasing channels

10.7 Healthcare and Life Sciences

10.7.1 Need to meet challenges and survive in the competitive market

10.8 Manufacturing

10.8.1 The migration of applications to a cloud environment allows manufacturers to adopt intelligent manufacturing technologies

10.9 Energy & Utilities

10.9.1 Energy and utility companies use various software applications to increase productivity and efficiency

10.10 Other Industries

10.10.1 Need to process large unstructured data and storage to accelerate the adoption of application hosting services

11 Application Hosting Market by Region

12 competitive landscape

12.1 Overview

12.2 Market Valuation Framework

12.3 Competitive Scenario and Trends

12.3.1 Product Launches

12.3.2 Transactions

12.4 Market Share Analysis of Top Players

12.5 Historical Earnings Analysis

12.6 Company valuation matrix overview

12.7 Business Valuation Matrix Methodology and Definitions

12.7.1 Stars

12.7.2 Emerging Leaders

12.7.3 Omnipresent Players

12.7.4 Participants

12.8 Company Product Footprint Analysis

12.9 Company Market Ranking Analysis

12.10 Scoring matrix for start-ups/SMEs: methodology and definitions

12.10.1 Progressive Companies

12.10.2 Responsive Companies

12.10.3 Dynamic Enterprises

12.10.4 Starting Blocks

12.11 Competitive Benchmarking for SMEs/Start-Ups

13 company profiles

13.1 Major Players

13.1.1 AWS

13.1.2 IBM

13.1.3 Google

13.1.4Microsoft

13.1.5 Rack space

13.1.6 LiquidWeb

13.1.7 Sungard As

13.1.8 Dxc Technology

13.1.9 Appendix

13.1.10 Navisite

13.1.11 SpectrumEnterprise

13.1.12 Capgemini

13.1.13 Digital Ocean

13.1.14 Oracle

13.1.15 Nce Corporation

13.1.16 Bluehost

13.1.17 Hostgator

13.1.18 Netmagic Solutions

13.2 Entrepreneurs/SMEs

13.2.1 Green Geeks

13.2.2 Cloud Paths

13.2.3 Host winch

13.2.4 Server Room

13.2.5 Hostarium

13.2.6 Apple Fleet

13.2.7 Bolt Flare

14 Neighboring/Related Markets

15 Appendix

For more information about this report, visit https://www.researchandmarkets.com/r/6cdd7n

Appendix

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Comments are closed.